The Ministry of Commerce of China

The Rapid Development of the Import of Services in China

In 2017, the total amount of the import of services in China was US$467.59 billion. This represents a year-on-year increase of 3.4%, a 230-fold increase when compared to 1982, shortly after the adoption of the market economy policy in China. At the beginning of the economic reform in the 1980s, service trade in China was in its infancy. In 1982, the country’s import of services was worth US$2.02 billion, accounting for only 0.4% of the world’s imports. When China joined the World Trade Organization (WTO) in 2001, its service imports were worth US$39.27 billion, which accounted for 2.6% of the world’s imports. This represents an increase of 18.4 times when compared to 1982. Since joining the WTO, China has actively sought to integrate itself into the world’s economic system and has proactively imported global quality services.

From 2001 to 2017, China's service imports increased by eleven times, with an average annual growth rate of 16.7%, ranking first in the world's major economies. Since 2012, China has adhered to the new development concept of market-oriented economy. Against the background of the slow growth of global trade, the proportion of Chinese service imports in global service imports rose from 6.3% in 2012 to 9.0% in 2017. As a result, the world ranking of China in terms of service trade jumped from the 10th to the 2nd place internationally. In 2017, the top five countries for global service imports were the United States (US$538.11 billion), China (US$467.59 billion), Germany (US$323.65 billion), France (US$240.47 billion), and the United Kingdom (US$214.95 billion). The top five trading partners for China's service imports are Hong Kong, the United States, Japan, Australia, and Canada, with service imports amounting to US$89.22 billion, US$87.08 billion, US$32.96 billion, US$26.92 billion, and US$23.16 billion, respectively.

The scale of China's service imports is much larger than its exports. In 2001, China's service trade deficit was US $ 100 million, and in 2012 it expanded to US $ 79.72 billion, an increase of nearly 800 times, with an average annual growth rate of 83.6%. In 2017, China's service trade deficit further expanded to US $ 239.05 billion, which is three times that of 2012. The top five sources of China's trade deficit in services in 2017 were the United States, Hong Kong, Australia, Canada, and Japan. According to statistics from the United States, from 2007 to 2017, the value of U.S. services exports to China increased from $ 13.14 billion to $ 57.63 billion, an increase of 3.4 times, while the value of U.S. services exports to other countries and regions in the world increased by 1.8 times during the same period. From 2007 to 2017, the US annual trade surplus in services to China expanded 30 times to US$40.2 billion.

Since the country's economic reform, the demand for overseas travel, consumption, study abroad, and medical services in China has increased significantly. Over the past 35 years, travel has been the largest area of China's service imports. From 2005 to 2017, travel service imports in China has increased from US$21.76 billion to US$254.79 billion, with an average annual growth rate of 22.8%. The share of travel services imports has increased from 25.9% to 54.5% of China’s overall service imports. China's imports of travel services represent an increase from 3.3% to 19.8% of global travel services imports. With the advancement of supply-side structural reforms and economic transformation and upgrading, imports of emerging services centred on technology and quality has continued to grow in China.

In 2017, imports of traditional services in China were US$356.48 billion, an increase of 1.8% from the previous year, whereas imports of emerging services were US$111.11 billion, an increase of 9.0% from the same period over the last year. Traditional service imports and emerging service imports accounted for 76.2% and 23.8% of China's total service imports, respectively. The contribution rate of traditional service imports and emerging services imports to the growth of China's service imports was 41.0% and 59.0% respectively. Since 2012, telecommunications and information services increased by 2.5 times the average annual growth of 28.4%, personal cultural and recreational services grew 3.9 times the average annual increase of 37.3%.

China's inward foreign affiliates (FATS) trade in services has developed very rapidly over the last three decades. Regardless of key indicators such as service sales revenue and total profit, or the number of companies and employees, inward foreign affiliate trade in services in China has outperformed outward foreign affiliates (FATS) services trade. In 2016, there were 123,520 inward FATS with a sales income of US$853.04 billion and total profits of US$130.17 billion. More than 5.37 million people employed at inward FATS by the end of 2016, of which foreign staff accounted for about 2.9% of the total number of employees. The top five industries in terms of sales revenue are leasing and business services, real estate, information transmission, computer services and software, wholesale and retail, transportation, storage and postal services.

Their sales revenues were US$190.04 billion, US$143.95 billion, US$136.88 billion, US$129.86 billion, and US$75.93 billion, respectively. In terms of countries (regions), the top five countries (regions) with largest sales revenue are Hong Kong, Japan, British Virgin Islands, Singapore and the United States, with sales revenues were US$478.26 billion, US$71.93 billion, US$60.82 billion, US$43.04 billion, and US$31.57 billion, respectively. The total sales revenue of inward FATS service companies from the above five countries and regions in 2016 was US$685.62 billion. This represents 80.4% of the total sales revenue of inward-oriented FATS engaged in services trade in China.

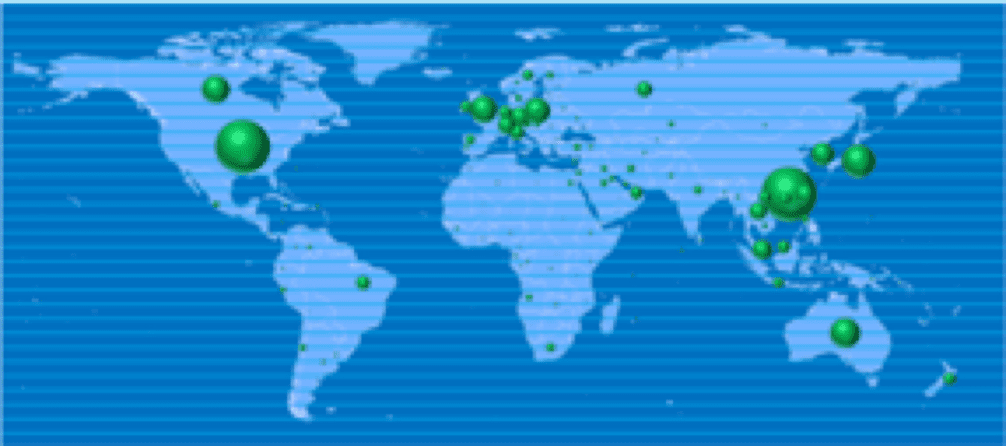

In 2013, the Chinese government approved the establishment of the China (Shanghai) Pilot Free Trade Zone. In 2015, while promoting successful reform piloting experiences, three free trade pilot zones in Guangdong, Tianjin and Fujian were established. In 2017, the Chinese government approved the establishment of 7 pilot free trade zones in Liaoning, Zhejiang, Henan, Hubei, Chongqing, Sichuan and Shaanxi. In 2018, the Chinese government decided to support the development of a free trade pilot zone in Hainan Island. China has become the largest trading partner of more than 120 countries and regions in the world. China is engaged in services trade with more than 250 countries. China's top ten import sources of services are Hong Kong, United States, Japan, Australia, Canada, the United Kingdom, Germany, South Korea, Taiwan, and Singapore. Imported services from these top ten trading partners totalled US$ 339.87 billion, accounting for 72.7% of China's total service imports.

Distribution of China's service imports from countries and regions of the world (p. 12)

United States is China's second largest source of service imports and the largest source of trade deficit in services. In 2017, China imported US$87.08 billion services from the United States, a year-on-year decrease of 1.5%, accounting for 18.6% of China's overall services imports. Travel is the most active and promising part of China-US economic and trade cooperation and cultural exchanges. In 2017, Chinese tourists spent US$51 billion on travel, study abroad, and medical treatment when visiting the United States. Approximately 3 million Chinese tourists visited the United States with a total tourism spending of US$33 billion. In terms of education, the United States is the largest destination for Chinese students studying abroad.

In 2017, there were about 420,000 Chinese students studying in the US, which contributed around US$18 billion US to the country’s economy. According to the US Bureau of Economic Analysis, in 2016, US affiliates in China realized service sales revenue of US$55.14 billion. The revenues generated by US professional, scientific and technical services were US$6.99 billion, information services US$ 2.74 billion, and financial and insurance services US$ 1.76 billion. By contrast, Chinese outward FATS in the US generated service sales revenue of US$3.18 billion, among which Chinese outward FATS providing financial and insurance services in the US generated revenues of US$1.17 billion, and the figure for Chinese FATS providing real estate leasing services was US$410 million. The difference between the sales revenue of Chinese outbound and inbound FATS (equivalent to the Chinese deficit) was US $ 51.96 billion.

Japan is China's third largest source of service imports. In March 2018, the 13th round of China-Japan-Korea FTA negotiations was held. The three countries held working group meetings on trade in services, telecommunications, financial services, natural person mobility, investment, competition policy, intellectual property, e-commerce and so on. The three countries had comprehensive and detailed exchanges of policies and measures on regional service trade management. During Premier Li Keqiang's visit to Japan in May 2018, the two sides signed the Memorandum on Strengthening Cooperation in Trade in Services, having agreed to establish a bilateral service trade cooperation mechanism. This has actively promoted the mutually beneficial cooperation in the service area between China and Japan.

In 2017, China imported US$32.96 billion of services from Japan, a year-on-year increase of 10.5%. Tourism service imports were US$18.03 billion, a year-on-year increase of 12.5%, accounting for 54.7% of China's total imports of services from Japan. In 2017, there were 7.356 million Chinese tourists visiting Japan, a year-on-year increase of 15.4%. Chinese tourism has taken the top position in Japan’s overseas tourism for three consecutive years.

Australia is China's fourth largest source of service imports. The China-Australia Free Trade Agreement is the first high-level free trade agreement signed between China and major developed countries. The two countries have reached high-level negotiations in the service area. Australia is the first country in the world to make a commitment to open its services to China in the form of a negative list. A major breakthrough was achieved in personnel exchanges between China and Australia, and Australia agreed to establish an investment facilitation mechanism. Australia agreed to create a "green channel" for visa and work permit applications for engineering and technical personnel working on projects in Australia with Chinese investment. Australia adopts "Vacation Work Visa Arrangement" to provide Chinese youth to Australia with 5,000 holiday work visas per year.

Australia is seen in China as an internationally competitive education service provider. China promises to review, evaluate and register on the website of Chinese Ministry of Education's Foreign Education Supervision Network the list of the 77 Australian higher education institutions registered with the Australian Federal Government Recruiting Overseas Student Institutions and Courses Registration Authority (CRICOS), within one year of the agreement entering into force. This arrangement will help Chinese students studying abroad to obtain accurate and authoritative information in a timely manner. China and Australia also decided to expand and deepen further cooperation in education services. Australia welcomes Chinese educational institutions to set up Chinese International Schools in Australia. China imported US $ 26.92 billion in services from Australia in 2017, a year-on-year increase of 8.2%. Travel and transportation are the main sectors, accounting for 96.2% of China's total imports of services from Australia. China’s imports of travel services from Australia was US$21.44 billion, an increase of 5.6%, accounting for 79.6%. Imports of transport services from Australia amounted to US$4.48 billion, an increase of 26.9%, accounting for 16.6%.

China's service imports cover various service areas. Import of travel services. China's travel service imports in 2017 were US $ 254.79 billion, a year-on-year decrease of 2.4%. The imports of tourism, study abroad, and medical services were US$186.21 billion, US$66.35 billion, and US$2.23 billion, respectively, accounting for 73.1%, 26.0%, and 0.9% of China's overall services imports. From 2001 to 2017, China's travel service imports increased by 18.3 times, with an average annual growth rate of 20%. From 2012 to 2017, China's contribution to the growth of world travel service imports was 56.3%, ranking first in the world. China has maintained the status of the world's largest outbound tourist source and consumer country for six consecutive years.

China’s outbound tourism consumption has contributed about one-sixth of the world ’s added value in tourism, created about a quarter of world employment in tourism, contributing more than 10% to the growth of international tourists in global tourism. 130 million Chinese citizens travelled abroad in 2017, a year-on-year increase of 7.0%. The consumption of Chinese tourists is close to one-fifth of the total global tourism income. In 2017, China was the largest source of inbound tourism for Japan, Thailand, Singapore, South Korea, Vietnam, Indonesia, Russia, Cambodia, Maldives, and South Africa, the corresponding travel service imports amounted to US$18.03 billion, US$6.53 billion, US$6.36 billion, US$5.30 billion, US$2.80 billion, US$1.72 billion, US$1.06 billion, US$500 million, US$340 million, and US$180 million.

Telecommunications and information services imports. By the end of the year of 2017, a total of 87 foreign-invested telecommunications companies have been approved in China, mainly providing information services, online data processing services and domestic call centres service. Foreign investment in Chinese domestic telecommunications companies and overseas listing of Chinese telecommunications companies have created new growth points for China's telecommunications services imports.

Digital upgrade of China's traditional manufacturing industry and the development of emerging platform economy and sharing economy have released a large demand for telecommunications computers and information services imports. From 2001 to 2017, China Telecom's computer and information services imports increased from US$670 million to US$19.18 billion, an increase of 28.6 times. In 2017, China Telecom's computer and information service imports increased by 52.5% year-on-year, accounting for 4.1% of China's total service imports. Imports of telecommunications services were US$1.80 billion, up 26.9% year-on-year; imports of computer and information services were US$17.37 billion, up 55.7% year-on-year.

Professional and Management Consulting Services Import. After China's entry into the World Trade Organization, China has substantially opened up its professional and management consulting services market. Demand for professional services such as legal services, accounting services, audit services, and management consulting has been accelerated. From 2015 to 2017, China's imports of professional and management consulting services increased from USD 13.94 billion to USD 16.18 billion, an increase of 16%. In 2017, China's imports of professional and management consulting services increased by 5.9% year-on-year, accounting for 3.5% of China's total service imports.

Financial services imports. Since China's entry into the WTO, China has further relaxed restrictions on foreign banks' geographic and customer targets; has opened RMB retail business and bank card business, and introduced foreign strategic investors to participate in the shareholding reform of large state-owned commercial banks. In 2005, China began to implement a managed floating exchange rate system based on market supply and demand and adjusted with reference to a basket of currencies. China implemented Qualified Foreign Institutional Investor (QFII) and Qualified Domestic Institutional Investor (QDII) mechanisms. Foreign central banks, international financial organizations, and sovereign wealth funds were allowed to use the RMB to invest in the interbank market.

Shanghai-Hong Kong Stock Connect, Shenzhen-Hong Kong Stock Connect and Bond Connect were launched. An interconnected domestic and overseas capital market mechanism was established. In 2009, China implemented a pilot RMB settlement for cross-border trade. The Chinese RMB was added to the Special Drawing Rights (SDR) currency basket in 2015. As of the beginning of 2018, among the 40 classifications of the International Monetary Fund's (IMF) capital account, China has fully or partially converted more than 35 items. The expansion of the financial industry and the emergence of Internet finance have enabled the acceleration of the financial consumption of Chinese residents, and the growing demand for imported financial services. From 2001 to 2017, China's financial services imports increased from US $ 80 million to US $ 1.62 billion, an increase of about 20 times.

Personal cultural and entertainment services imports. Since 2015, China has signed agreements with Israel, Korea, Egypt and other friendly countries to carry out cultural trade and cooperation. China has held large-scale cultural exchanges such as the China-France Cultural Year and the Sino-Russian Cultural Year. From 2001 to 2017, China's personal cultural and entertainment services imports increased from US$50 million to US$2.75 billion, a 55-fold increase.

China Service Import Outlook.

Prioritizing the development of service trade is an important measure to promote China's economic transformation and service upgrading. Service trade has become a new driving force for China's foreign trade development and a new engine for deepening its social transformation. With the vigorous growth of the service industry, the development of China's service trade has been well supported. In 2017, the value-added of China's service industry accounted for 51.6% of its GDP. The contribution of the service industry to the overall economic growth was 58.8%. China will steadily further the opening-up of its financial industry, relax restrictions on the establishment of foreign financial institutions, and expand the scope of foreign financial institutions' business in China. China will broaden China-foreign financial market cooperation. China will cancel or relax restrictions on foreign investment in transportation, commerce and logistics, and professional services. China will further increase foreign investment access to its accounting and auditing, architectural design, and rating services. China will promote the orderly opening of telecommunications, the Internet, culture, education, transportation and other fields. China will explore and improve the service trade market access system within the framework of cross-border delivery, overseas consumption, and movement of natural persons.

Promotion of coordinated regional development. China will leverage the leading role of high-quality service imports in eastern China. Promoting service imports has become an important breakthrough for the development of an open economy in the central and western regions of China. Economic and technological development zones, special customs supervision zones, high-tech industrial development zones, national tourist resorts and other development zones will be established as important platforms and carriers for service imports.

Expansion of imports of high-quality services. As the largest developing country in the world, China is in an important period of economic transformation and upgrading towards high-quality social development. There is strong demand for productive services such as R&D design, energy conservation and environmental protection, information technology, financial insurance, third-party logistics, business consulting, and brand building. China will build a well-off society in an all-round way, the living standards of residents will continue to improve, and the demand for lifestyle services such as health care and cultural creativity will increase. Expanding service imports is conducive to promoting high-quality economic development, satisfying people's longing for a better life, and improving the sense of happiness and gain of the Chinese people. China's service imports are increasingly integrated with new technologies such as big data, cloud computing, and artificial intelligence. Integration with new economies such as the digital economy, sharing economy, and Internet economy is deepening. Services import is increasingly coordinated with the development of manufacturing, service, and agriculture. It is estimated that the scale of China's service imports will exceed US$2.5 trillion in the next 5 years, accounting for more than 10% of global service imports. It contributes more than 20% to the growth of global service imports. China’s outbound tourism will reach US$700 million, and travel service imports are expected to exceed US$1.4 trillion. Accumulative imports of emerging services such as intellectual property royalties, telecommunications, computer and information services, financial services, insurance services, personal culture and entertainment services will exceed US$700 billion.

Creation of a service import promotion platform. China's service imports will be led by China International Import Expo and China (Beijing) International Service Trade Fair. China will leverage the import promotion function of China (Shanghai) International Technology Import and Export Fair, China International Software and Information Service Fair, China International Service Outsourcing Fair, China (Shenzhen) International Cultural Industry Expo and Trade Fair, China (Hong Kong) International Service Trade Fair. China will actively build national and regional public service platforms and improve the utilization efficiency of existing public service platforms. China will encourage financial institutions to innovate and adapt to the characteristics of service trade under the premise of controllable risks and sustainable business. China will continue to explore the construction of a number of overseas promotion centres for service trade and online promotion platforms for service trade in order to make better use of the role of trade promotion agencies and industry associations. In 2018, China deepened the pilot development of service trade innovation in Beijing, Tianjin, Shanghai and other regions, giving full play to local initiative and creativity.

China will engage actively with trials in the service trade management system, open path, promotion mechanism, policy system, regulatory system, development model, etc. China will accelerate the optimization of the business environment, maximize market vitality, and stimulate innovative development of service trade.

China will deepen multilateral and bilateral cooperation in trade in services. China will promote negotiations on the Regional Comprehensive Economic Partnership Agreement and advance the construction of the Asia-Pacific Free Trade Area. China will build on the achievements of the China-ASEAN Framework Agreement on Comprehensive Economic Cooperation and Service Trade Agreement and further promote the liberalization of trade in services with these countries. China will promote China-ASEAN service trade cooperation to a new level, and will actively promote the negotiation of China-Japan-Korea Free Trade Agreement.